Dynamics of Russia's squid imports by product form and species in 2004-2007. Full story.

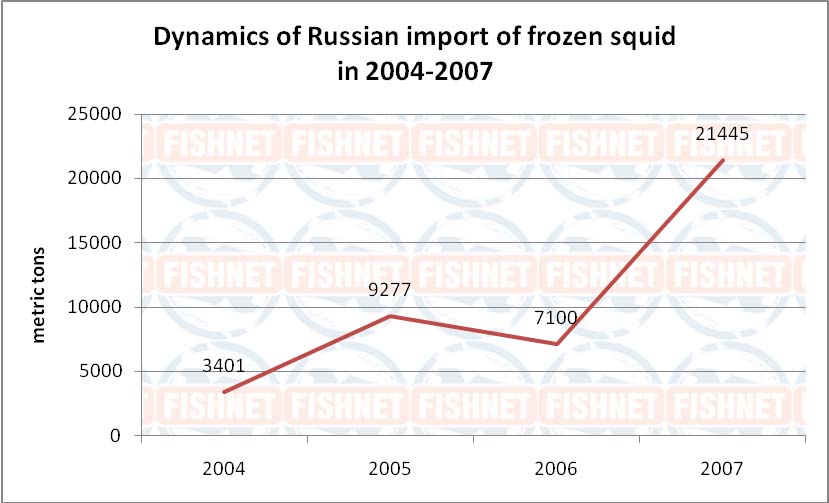

In the period from 2004 to 2007 the Russian market of imported squid displayed mixed trends with a rise in 2005, a decrease in 2006 and a dramatic rise in 2007.

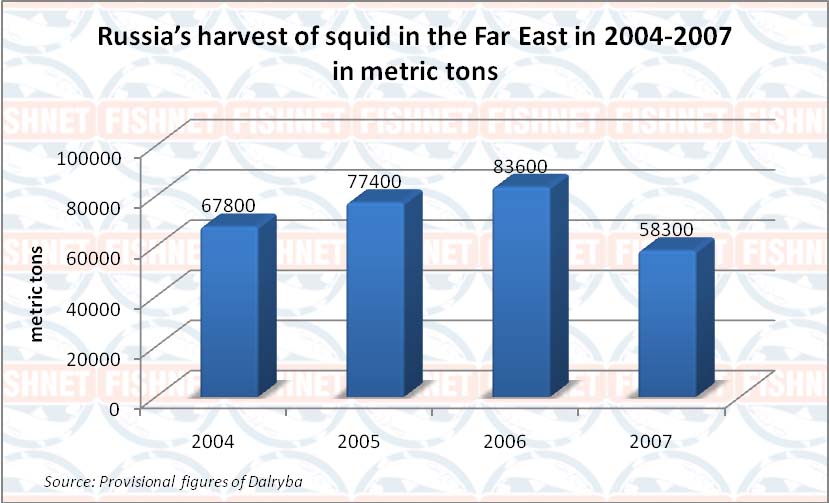

Though the Russian market of squid was still dominated by domestically-produced frozen products originating from the nation's Far East, by the year 2007 a considerable share of the market was occupied by imported products.

As for squid imports, it was practically completely represented by value-added products such as mince, cleaned tubes, rings, tentacles, seafood cocktail, etc. The Russian importers also purchased frozen squid, but its share in the total volume of squid imports did not exceed 10%.

From such countries as Chile, Peru and Argentina the importers brought mostly cleaned tubes, fillets, mince, wings, tentacles and other products. In the meantime, value-added products such as rings, fillets and seafood cocktail mostly in poly packs were imported from China, Thailand, Vietnam, Denmark, Spain and Belgium.

Although the below report focuses on Russia's import of frozen products, it is fair to notice that the country has been also importing a considerable volume of salted and dried squid. More specifically, according to expert estimates, the largest supplier of these products was China with the volume of more than 8000 tonnes in the first 10 months of 2007.

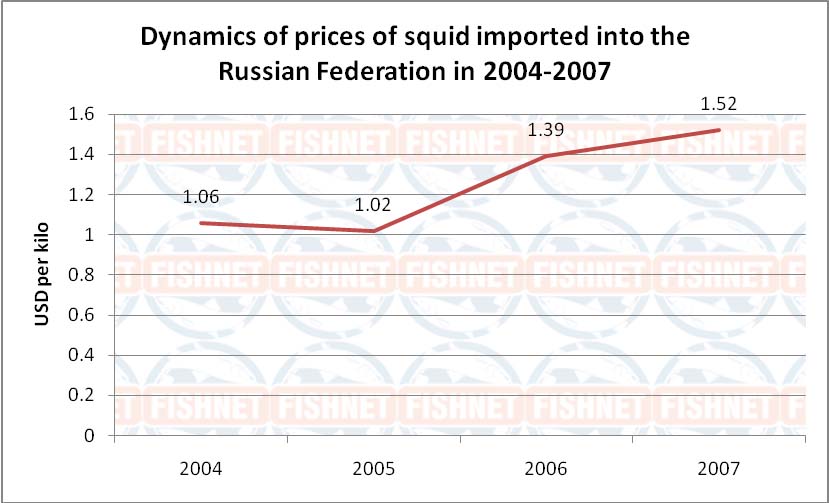

Prices

Average prices of imported squid in 2005-2007 grew nearly 1.5-fold from 1.06 to 1.52 USD per kilo with a special rise recorded in 2006 when prices jumped by 36%. The largest appreciation was reported for squid meat (+43%), tubes and surimi (+39%). Frozen squid and seafood cocktails appreciated by 32%. The lowest price rise was observed for squid fillets the prices of which grew by 16%.

In the year 2007 the price growth slowed down and amounted to 9%. The positive trend of squid prices could be attributed to a 22% growth of frozen squid prices, a 12% rise of surimi prices, an 11% rise of seafood cocktails and a 6% growth of squid meat. In the meantime, squid tubes depreciated by 3% and squid fillet prices remained unchanged.

The larger growth of prices of frozen w/r squid as compared to other products could be explained by growing share of more expensive products meant for sale to restaurants and supplied in small lots.

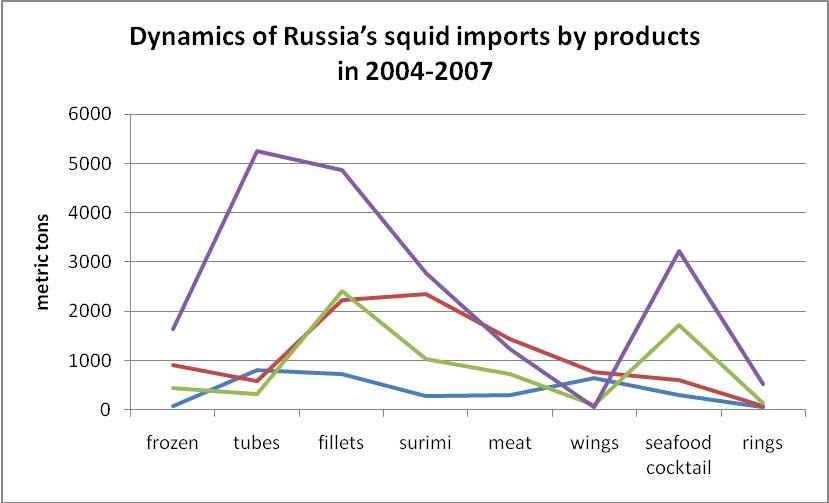

Russia's squid imports by products

From 2004 to 2007 the Russian import of squid products displayed a shift of shipments towards value-added products for the retail sector and the HoReCa as well as convenience products ready to eat.

The trend could be clearly seen in the graph as below. During the period under analysis there was a stable growth of import of such products as squid fillets, cocktail and rings. Despite a total decrease of import volumes in 2006, purchases of the above mentioned products did not decline, but even went up.

That could be explained by a steady demand for value-added products from restaurants, cafes and other foodservice business against insufficient domestic supply. Such products are remarkable for their convenience as they do not need to be cooked for a long time. Besides, consumers' preferences also shift to convenience products and squid tubes have been imported into the country mostly in cleaned and blanched form thus making the product more attractive for cooking as compared to block frozen skin-on tubes.

In the period from 2004 to 2007 Russia's imports of squid products displayed mixed trends. More specifically, from 2004 the nation's purchases of squid products decreased from 820 tonnes to 576 tonnes in 2005 and to 341 tonnes in 2006, followed by a dramatic increase to 5257 tonnes in 2007. Growing shipments of squid tubes could be attributed to rises of purchases from such countries as Argentina, China, New Zealand, Taiwan and to a smaller extent from other countries.

In 2004-2007 the Russian importers purchased tubes of such squid species as Illex, Loligo, Todarodes pacificus, Notodarus, etc. The products were shipped to Russia both in cleaned, frozen form in cartons, bags and in poly packs of 500 grams, 1 kg, 2.5 kg and 5 kg.

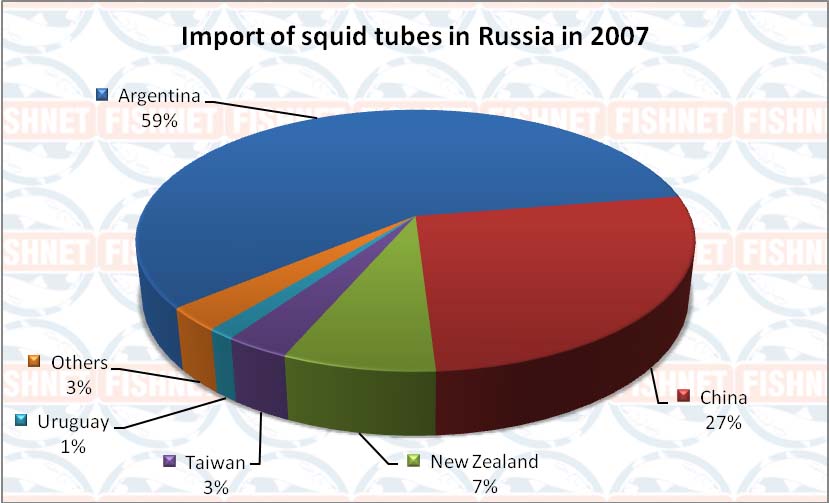

Though import of squid tubes from 2004 to 2006 was decreasing, in 2007 there was a large rise of shipments of the product. The large rise could be attributed to reduced catches of squid in the Russian Far East with the resulting shortage compensated by large purchases of Argentinean squid. The share of Illex tubes originating from Argentina (which is actually a direct competitor of B.magister squid harvested in the Russian Far East) in the total import of squid in 2007 accounted for 59%. The volume of Russia's purchases of Illex tubes from the country jumped from zero in 2006 to 3079 tonnes in 2007. The average prices of Argentinean Illex tubes imported to Russia amounted to 1.56 USD per kilo (ca.RUB55.00-60.00 per kilo in wholesale trade) which was smaller as compared to the Russian Far East squid prices of ca.65.00-70.00 per kilo in 2007.

The Russian importers purchased frozen non-cleaned or cleaned Illex tubes in cartons or poly packs mostly directly from Argentina, the production country, and via Germany.

The second place in shipments of frozen squid tubes to Russia belonged to China with a share of 27%. The volume of Russia's shipments of Chinese squid in 2007 amounted to 1397 tonnes, which was 11 times larger as compared to 125 tonnes in 2006.

China shipped to Russia tubes of such squid species as Illex and Todarodes pacificus. Products from China were more value-added including glazed and shatter packed products under such trademarks as Bukhta Izobilia and TIMAX in poly packs varying in weight from 500 grams to 5 kilos. Therefore, the average prices of Chinese squid tubes imported into Russia were somewhat larger than those of Argentinean squid, 1.63 USD per kilo. The products from China were shipped directly to Russia and only a small share of squid was imported via Germany.

The third largest producing country for squid tubes meant for the Russian market was New Zealand with a share of 7%. The volume of Russia's purchases of squid tubes from New Zealand came up from 1 tonne in 2006 to 391 tonnes in 2007. From New Zealand the Russian importers shipped block frozen gutted Nototodarus squid in cartons for sale and processing. The shipments were carried out directly from New Zealand. The average prices of NZ squid tubes amounted to 1.50 USD per kilo.

Other producer countries for squid tubes imported into Russia were Taiwan, Uruguay, Spain, South Korea, Peru, India, Thailand and other. The geography of shipments was actually very wide.

There was also a drastic rise of shipments of squid tubes from Taiwan (from zero to 167 tonnes), Spain (from zero to 37 tonnes), Uruguay (from 18 to 71 tonnes), India (from 510 kilos to 17 tonnes).

However, not all the countries displayed increases of shipments to Russia. For example, in 2007 the Russian importers completely ceased purchases of squid tubes from the USA which shipped 74 tonnes of B.magister squid tubes in 2006.

Fillets

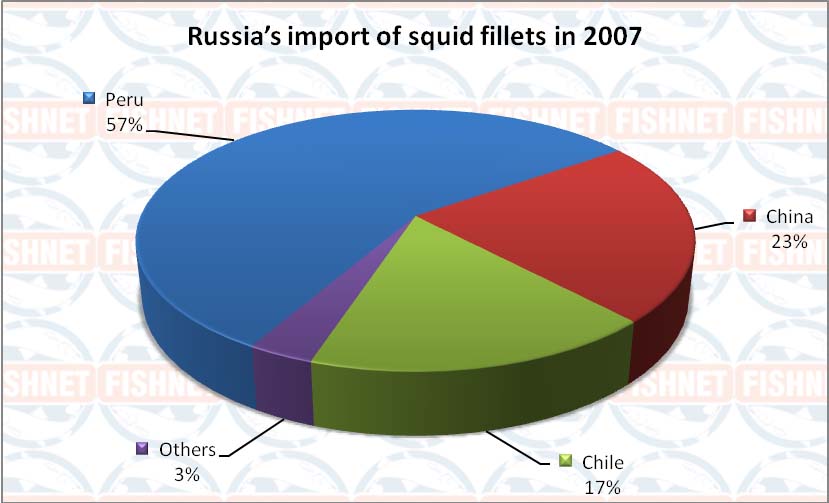

The second most important imported product form was squid fillets. Regardless of the general trend, Russia's import of squid fillets was steadily growing. In the year 2004 Russia's import of squid fillets amounted to 733 tonnes, in 2005 it jumped to 2227 tonnes, in 2006 it rose to 2412 tonnes and in 2007 the shipments dramatically increased to 4878 tonnes. Prices of squid fillets did not change much and fluctuated from 1.21 USD per kilo in 2004 to 1.29 USD per kilo in 2007.

Main suppliers of squid fillets to Russia were Peru, China and Chile. The shares of remaining countries (Belgium, Japan, Argentina, Thailand and Italy) were insignificant.

Russian traders purchased fillets of such species as Dosidicus gigas, Sepioteuthis, Ommastrephidae, Illex and Todarodes pacificus. Products were imported in frozen cleaned form in cartons, bags and poly packs.

Peru was the largest country producing squid fillets for Russia with a share of 57%. The volume of Russian import of squid fillets from the country grew by 87% from 1483 tonnes in 2006 to 2777 tonnes in 2007.

Peruvian traders shipped frozen fillets of giant squid Dosidicus gigas, cleaned in 30-kilo poly packs and 20-kilo cartons for sale on the domestic market. The average import prices for Peruvian fillets of giant squid in 2007 amounted to 1.27 USD per kilo. Shipments of fillets were carried out directly from Peru.

The second largest producer of squid fillets for Russia was China with a share of 23%. The total volume of Russia's imports of squid fillets from the country jumped 2.25-fold from 491 tonnes in 2006 to 1105 tonnes in 2007.

From China the Russian traders imported mostly squid fillets (Ommastrephidae and Illex) IQF for sale on the domestic market in 1-kilo poly packs. Average import prices of the products amounted to 1.66 USD per kilo. All the supplies were carried out directly from the producing country.

The third largest supplier of squid fillets was Chile with a share of 17%. The volume of import from the country grew 2.47-fold from 339 tonnes in 2006 to 837 tonnes in 2007.

From Chile the Russian importers purchased frozen fillets of giant squid Dosidicus gigas for sale on the domestic market in 10-kilo bags. All shipments were carried out directly from Chile. The average import prices per kilo of fillets amounted to 1.28 USD per kilo.

Besides, squid fillets were imported from Belgium, Thailand, Japan, Peru, Denmark and Italy. Mostly the imported products were in poly packs from 500 grams to 2 kilos.

Along with the above, the Russian traders also purchased squid fillets from Japan. More specifically, the importers purchased fillets of squid Ommastrephidae in poly packs of 700 grams in the film-covered foam plastic and squid Nototodarus shipped via Finland. Besides, the Russian importers also purchased cuttlefish fillets via the USA, though there were small single shipments.

Seafood cocktail

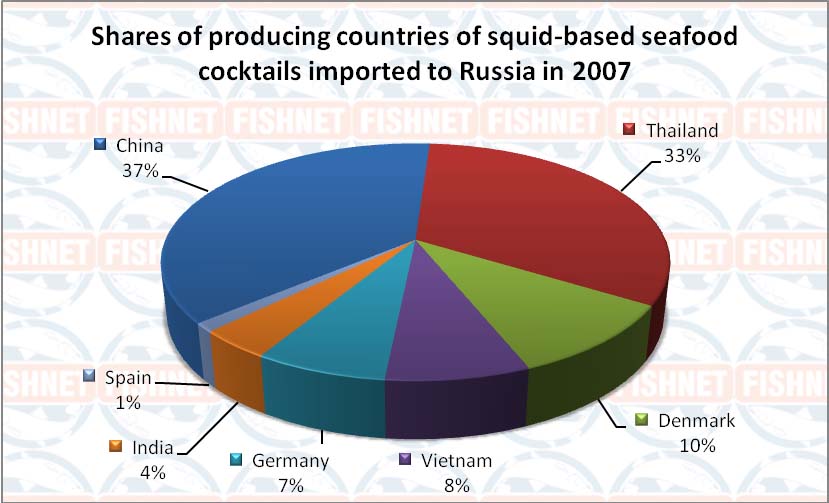

Another important article of Russia's squid import was seafood cocktail. The value-added products were shipped in retail packs under the labels of Nordic Delight, Sirena, Marisol and Bukhta Izobilia.

Apart from squid which was the main component (30-60%) of the product, seafood cocktails contained such species as shrimp, octopus, mussels and other mollusks in various proportions. As the main component of seafood cocktails producers used Loligo squid and other squid species at a smaller extent.

Just like the case with fillets, Russia's imports of seafood cocktails showed stable growth for the whole period from 2004 to 2007. The volume of imports amounting to 300 tonnes in 2004 jumped to 602 tonnes (+100%) in 2005. In the year 2006 the import volume grew to 1722 tonnes (+186%) and by the year 2007 the import volume reached 3223 tonnes, 87% up on 2006. The trend was caused by actively rising demand from the HoReCa and retail sectors as well as consumers' growing interest in exotic dishes.

More than two thirds of Russia's imports were contributed by China and Thailand, while the remaining share was contributed by Denmark, Vietnam, Germany, India and Spain.

The largest producer of seafood cocktails for Russia was China with a share of 37%. The volume of Russia's import from the country jumped 7.3-fold from 164 tonnes in 2006 to 1199 tonnes in 2007. The products were shipped directly from China in 500-gram, 1-kilo and 2.5-kilo poly packs. The product's average import prices amounted to 1.62 USD per kilo.

The second largest producing country for seafood cocktails was Thailand with a share of 33%. The import volume from the country grew by 4% from 1013 tonnes in 2006 to 1053 tonnes in 2007. Besides, just like the case with China, products from Thailand were delivered to Russia in packed form in poly packs from 500 grams to 5 kilos for sale on the market. Thai cocktails contained mostly loligo squid. The average prices per kilo of the products amounted to 1.67 USD per kilo.

The third place in Russia's import of seafood cocktails was taken by Denmark, which products were imported into Russia both directly and via the Baltic States (Lithuania and Estonia namely). The share of the country in the total import amounted to 10%. The volume of Russia's import of seafood cocktails from Denmark jumped 4-fold from 80 tonnes in 2006 to 327 tonnes in 2007. The cocktails were also based on Loligo squid. The seafood cocktails were shipped in 250-gram and 500-gram packs. The average import prices per kilo of Dannish cocktail amounted to 1.92 USD per kilo.

Other large producers of seafood cocktails for Russia were Vietnam, Germany, India and Spain. Russia's import of Vietnamese cocktails grew 2.7-fold from 90 tonnes in 2006 to 249 tonnes in 2007, while purchases from Germany jumped 8.4-fold from 28 tonnes to 235 tonnes, India - 33-fold from 3 tonnes to 99 tonnes and from Spain - 1.7-fold from 23 tonnes to 29 tonnes.

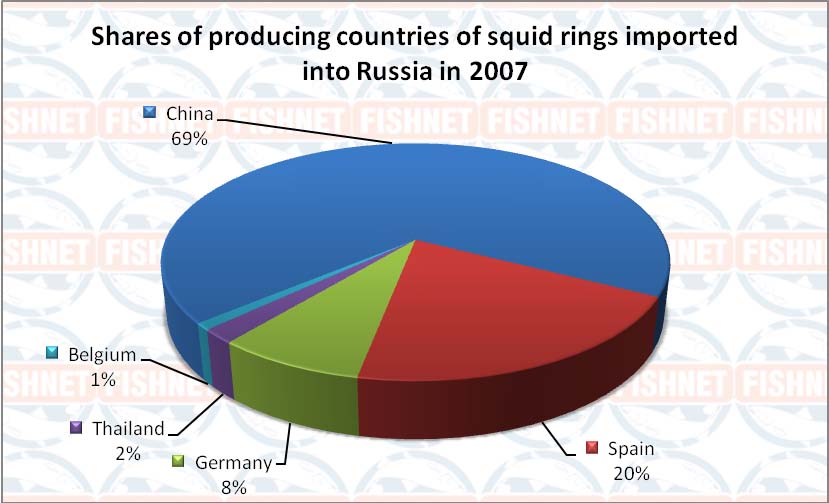

Squid rings

Apart from seafood cocktails, the Russian traders also purchased squid rings. Just like seafood cocktails, shipments of squid rings kept gathering momentum in 2004-2007. The import volume in the period under analysis was continuously growing against the general trend. In 2004 the volume of Russia's import of squid rings amounted to 61 tonnes only, in 2005 the volume grew to 71 tonnes. By the year 2006 the import volume jumped more than two times and amounted to 153 tonnes and in 2007 the import volume reached 528 tonnes, 3.5 times up on 2006. The average import prices grew by 68% from 1.23 to 2.07 USD per kilo.

The largest producers of squid rings for Russia were Spain and Germany, however in 2007 China won the first place as it boosted its shipments for Russia 19-fold from 19 tonnes in 2006 to 363 tonnes in 2007. Chinese squid rings were imported mostly in blanched and packed form in shatter packs, in particular under the trademark of Bukhta Izobilia from 500 grams to 2.5 kilos. From China rings of squid Ommastrephidae and Todarodes pacificus were shipped directly to Russia. The average prices of Chinese products in 2007 amounted to 1.94 USD per kilo.

In 2007 Spain, the largest producing country in 2004-2006, remained far behind China with the share of а 20% only, though import from the country grew 2.25 times from 48 to 108 tonnes.

In the year 2007 shipments of frozen rings of squid Loligo and Illex from Spain were carried out directly and via Lithuania. The products were shipped in 500-gram poly packs under the trademark of Marisol. Besides, some of the products were imported in cartons for further processing. The average prices of squid rings originating from Spain amounted to 2.59 USD per kilo.

The third largest producer of squid rings, Germany, somewhat decreased the volumes of its shipments from 46 tonnes in 2006 to 42 tonnes in 2007. Rings of squid Todarodes pacificus from Germany were supplied in blanched form in 400-gram and 750-gram poly packs. The shipments were carried out via Lithuania. The average prices of squid rings from Germany amounted to 2 USD per kilo.

Other producers with small volumes were Thailand and Belgium. From Thailand the Russian importers purchased Loligo squid rings in 500-gram retail packs, while from Belgium they brought rings of Sepioteuthis squid in 1-kilo bags.

Squid-based surimi

Another important product form in Russia's squid import was squid mince (surimi). The import volumes of squid surimi displayed fluctuations in 2004-2007. From 2004 to 2005 the Russian imports were actively rising, in 2006 there was a decrease of shipments and in 2007 the imports rose again.

In the year 2004 Russia's import of squid-based surimi amounted to 295 tonnes only and by the year 2005 it jumped to 2345 tonnes. In 2006 the Russian purchases of squid surimi sank by 55% to 1038 tonnes, which was also confirmed by the Russian processors pointing out to the shortage of squid mince on the market. In 2007 the import volume also jumped by 167% to 2769 tonnes.

The average import prices of squid surimi in the period under analysis grew by 79% from 0.84 to 1.50 USD per kilo. The largest rise was observed in 2006 when prices increased by 39% from 0.97 USD per kilo in 2005 to 1.34 USD per kilo in 2006. In the year 2007 prices grew by 12% to 1.50 USD per kilo.

In the course of the period under analysis the largest and practically the only producer of surimi from squid Loligo and Dosidicus gigas was Peru. Only in 2005 the Russian importers purchased 25 tonnes of surimi from South Korea and in 2007 they purchased 19 tonnes of surimi mince from Lithuania. The remaining volume was imported from Peru and the shipments were carried out directly from the country.

The products were imported in lots from 25 to 100 tonnes in frozen form in 20-kilo cartons for further processing.

Such rise of Russia's import of squid surimi could be explained by expansion of the range of convenience products, ready-to-eat products and semi-processed products made by the Russian plants. Squid-based surimi was more actively used as an ingredient in production of fish cakes, ravioli, shaped products such as breaded rings as well as other ready-to-eat products.

For example, famous Russian company Meridian offers a product range containing squid mince.

Pre-fried salmon cakes with onion

Pre-fried salmon cakes with onion

Ingredients: salmon mince, squid mince, water, dried and finely ground bread-crumbs, vegetable oil, milk fat substitute, wheat flour, textured bread crumbs, dried milk, powdered eggs, salt, roasted onion flavor identical to natural, black pepper.

Pre-fried fingers "From pike perch with cheese"

Pre-fried fingers "From pike perch with cheese"

Ingredients: pike perch mince, squid mince, water, dried and finely ground bread-crumbs, vegetable oil, milk fat substitute, cheese, wheat flour, textured bread crumbs, dried milk, powdered eggs, salt, cheese flavor identical to natural, spices.

Squid rings in batter (surimi) (producer Pokotorg Company)

Squid rings in batter (surimi) (producer Pokotorg Company)

Net weight: 5 kg

Ingredients: squid mince, batter.

Ingredients: squid mince 67%, wheat flour, vegetable oil, salt (1.5%), corn starch, modified corn starch, red pepper powder, yeast, turmeric powder, milk protein, glucose syrup, baking powder E450, E500, E503.

Ingredients: squid mince 67%, wheat flour, vegetable oil, salt (1.5%), corn starch, modified corn starch, red pepper powder, yeast, turmeric powder, milk protein, glucose syrup, baking powder E450, E500, E503.

At the same time, apart from imported raw material, the Russian processors have been trying to boost output from domestically produced raw material. For instance, BPK onshore processing combine owned by Russia's largest squid producer Vladivostok-based OAO NBAMR (plc) has launched production of the value-added range with squid mince. More specifically, Morskoy Eskalop (sea cutlet) made by NBAMR's onshore factory consists of squid mince (50%) and Alaska pollock mince (50%). This is a breaded shaped product in batter pre-fried in oil.

Besides, there is a technology of production of crab sticks from squid surimi. However, there is no information on the use of the raw material by Russian producers of crab sticks.

Frozen squid

Russia's import of frozen squid in 2004-2007 displayed mixed trends. Just like the case with surimi, in 2005 the Russian importers increased their purchases, in 2006 decreased and boosted them again in 2007. In general, through the period under analysis Russia's import of frozen squid grew more than 19 times. In 2004 the Russian imports amounted to 84 tonnes only. In 2005 the Russian imports grew to 907 tonnes or more than 10 times. In the year 2006 the volume of shipments decreased to 452 tonnes or two times. By the year 2007 Russia's imports reached 1635 tonnes, 3.6 times up on 2006.

The share of frozen squid in the total Russian import did not exceed 10%. In the year 2004 the share amounted to 3% and in 2007 it reached 8%.

A considerable part of Russia's squid imports from 2004 to 2007 was contributed by w/r squid for human consumption and, at a smaller extent, by partly processed squid. The Russian importers purchased such squid species as Loligo, Ommastrephidae, Illex, Todarodes, Dosidicus gigas, Sepioteuthis and Nototodarus.

In 2007 there was a dramatic rise of shipments of Illex squid from Argentina from 7 tonnes in 2006 to 298 tonnes in 2007, Dosidicus gigas squid from Chile from 28 tonnes to 324 tonnes of Dosidicus gigas squid from Peru from 27 tonnes to 193 tonnes and Nototodarus squid from New Zealand from zero to 198 tonnes.

The average import prices of frozen squid from 2004 to 2007 grew approximately by 30% from 1.00 to 1.30 USD per kilo.

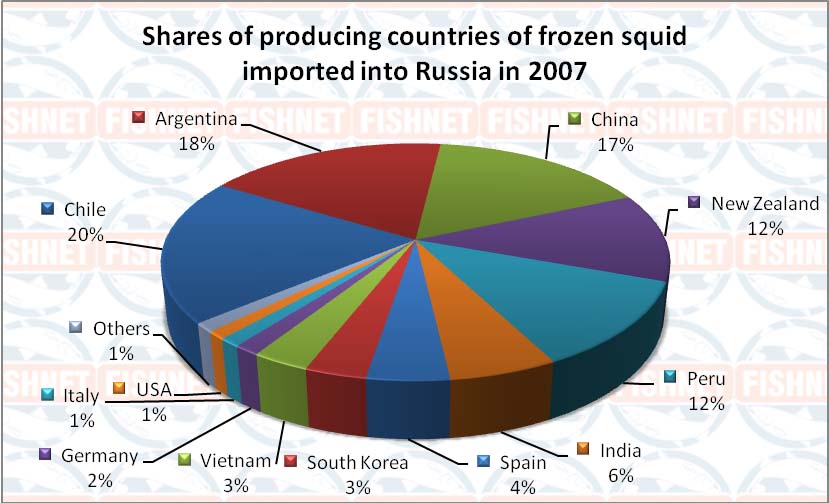

The largest producer of frozen squid for Russia was Chile. The share of the country in the total Russia's import amounted to 21%. The import volume from Chile reached 324 tonnes, 11.5 times larger on 28 tonnes in 2006. The total volume was contributed by giant squid Dosidicus gigas, gutted and cleaned for sale on the market and the produce was shipped to Russia directly from Chile. The average import prices of Chilean squid in 2007 amounted to 1.08 USD per kilo.

Argentina was the second largest producer of frozen squid for Russia. Thanks to a dramatic increase of shipments the country quickly won 18% of Russia's imports. From Argentina the Russian importers purchased Illex squid in non-cleaned form, frozen in cartons. The average import prices of Argentinean squid in 2007 amounted to 1.20 USD per kilo.

The third largest producing country of frozen squid for Russia was China with a share of 17%. From that country Russia imported squid Ommastrephidae, Illex and Todarodes mostly in cleaned form in cartons. The average import prices of Chinese squid amounted to 1.63 USD per kilo.

Besides, New Zealand entered the Russian market with the volume of 198 tonnes of frozen squid Nototodarus. The shipments were carried out directly in lots of ca.40 tonnes in 22.5 kilo cartons. The average prices of NZ squid amounted to 1.81 USD per kilo.

There was also a rise of Russia's imports of giant squid Dosidicus gigas from Peru from 27 tonnes to 193 tonnes. Shipments of the products were carried out in 30-kilo poly packs directly from Peru and via Germany. The average import prices amounted to 0.89 USD per kilo.

Squid wings and meat

Russia's import of frozen squid meat repeated the general trend. During 2004-2007 the volume of squid meat imports grew from 315 tonnes to 1222 tonnes. The largest import volume was observed in 2005 (1428 tonnes namely), but in 2006 Russia's purchases dramatically decreased to 740 tonnes and by the year 2007 (1222 tonnes) they did not recover to the level of 2005.

Squid meat was shipped to Russia for further processing into canned products. Mostly squid meat was shipped in the form of fillet and wing trimmings of giant squid Dosidicus gigas from Peru and Chile.

The largest producer of squid meat in 2007 was Peru with the volume of 922 tonnes, boosting its shipments for Russia by 137% as compared to 389 tonnes in 2006. The products were shipped in 20-kilo bags directly from Peru and via Germany. The average prices of squid meat from Peru amounted to 1.48 USD per kilo.

Chile, the second largest producing country, decreased shipments by 19% from 351 tonnes in 2006 to 294 tonnes in 2007. The shipments were carried out directly from Chile. The average prices of Peruvian squid meat amounted to 1.51 USD per kilo. Probably, higher prices of Chilean products were behind the decrease of imports from Chile and the rise of imports from Peru.

Also for further processing into canned products and sale on the domestic market the Russian importers purchased wings of giant squid Dosidicus gigas from Peru and Chile. However, the import volume from 2004 to 2007 was continuously decreasing. In the year 2004 it amounted to 649 tonnes, while by the year 2007 the volume dropped to 52 tonnes. The average prices of squid wings amounted to 1.57 USD per kilo.

Graph 9: Russia's harvest of squid in the Far East in 2004-2007 in metric tons